- Inheritance Tax/Gift Tax

- Practice Areas

- Taxation matters living abroad

Korean Inheritance/Gift Tax Treatment for Overseas Residents

The Smart Inheritance has developed unique capabilities over the course of 17 years,

roviding inheritance and gift tax services in Korea to clients residing in 20 different countries around the world.

roviding inheritance and gift tax services in Korea to clients residing in 20 different countries around the world.

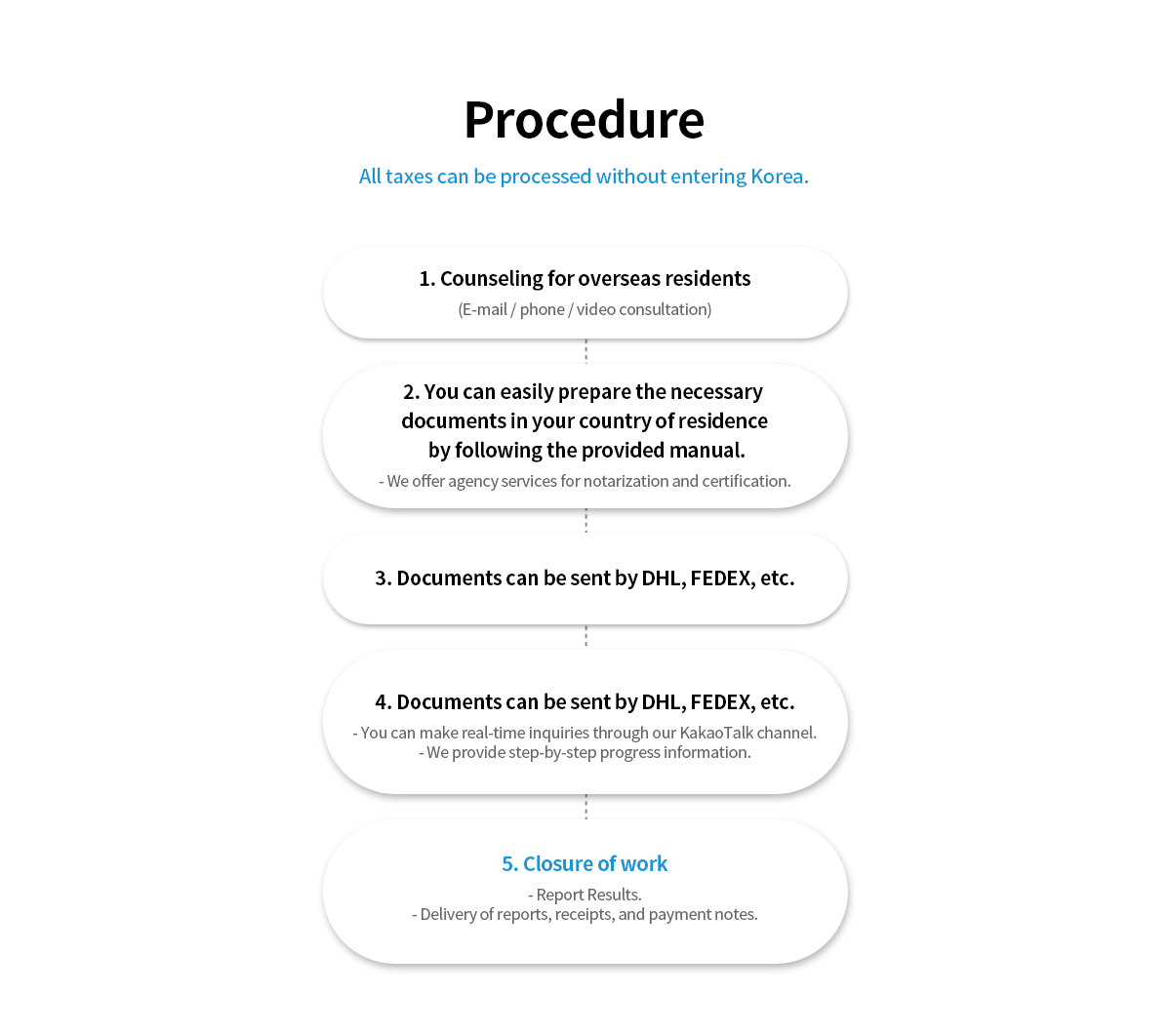

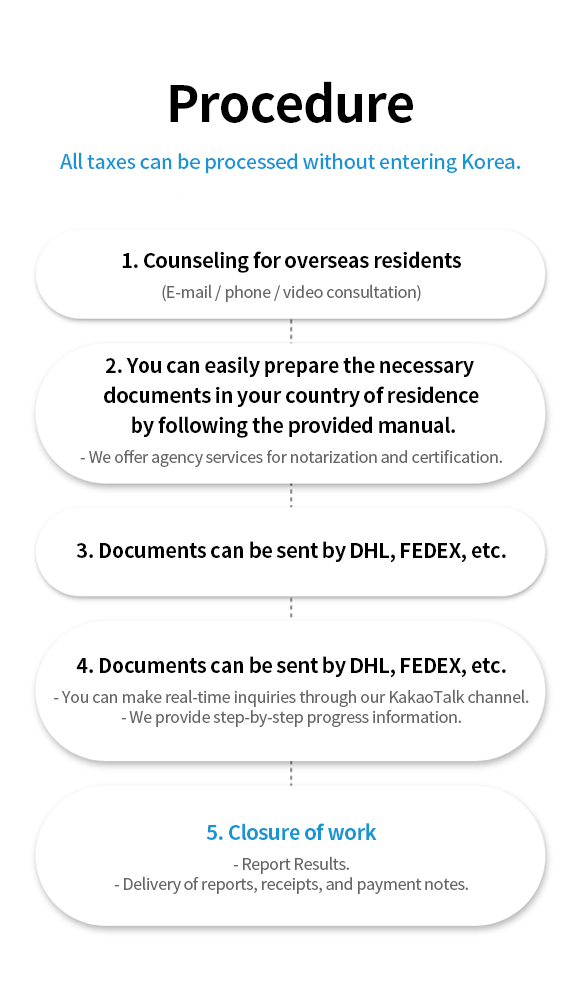

A service that does not necessitate entering Korea.

By meticulously preparing precise documents for each country of residence, conducting notarization

and certification procedures, we ensure convenient tax processing without the requirement of visiting Korea.

Furthermore, our team of specialized attorneys and tax accountants for overseas residents collaborate to devise

a comprehensive tax reduction strategy encompassing various taxes such as inheritance tax, gift tax, acquisition tax, capital gains tax,

and more, arising from the gift and inheritance process.

Main Cases

The main cases of inheritance tax and gift tax for overseas residents are as follows:

- 1. If your Korean parents have passed away, but some or all of your heirs reside abroad

- 2. In case the deceased who is an overseas citizen/permanent resident dies leaving property in Korea

- 3. In case the deceased who is a foreign citizen/permanent resident died while living in Korea and left inherited property abroad

- 4. When a family living in Korea transfers property to a family residing abroad

- 5. When a family member residing abroad transfers property to a family residing in Korea

- 6. Acquisition tax, capital gains tax, etc. arising from the process of inheriting and selling real estate in Korea