What tax solution do you need?

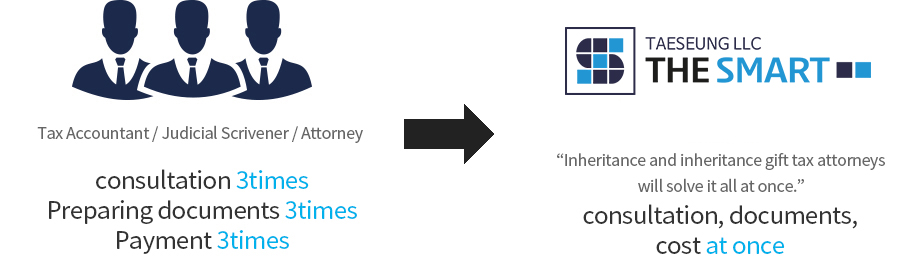

You no longer have to search separately. Inheritance Tax and Registration, Inheritance Determination!

Get it done in one go.

Get it done in one go.

Provides an optimal inheritance tax solution

that analyzes all inheritance issues in three dimensions!

that analyzes all inheritance issues in three dimensions!

Comprehensive consideration of property transfer, inheritance disputes,

and future utilization plans is a shortcut to tax savings.

and future utilization plans is a shortcut to tax savings.

Process for resolving inheritance taxes

-

01. Consultation with an attorney specializing in inheritance and gift tax

ㆍ Direct consultation with an attorney specializing in inheritance and gift tax officially registered with the Korean Bar Association.

ㆍ Suggest the most effective method for saving taxes.

-

02. Case request and dedicated team deployment

ㆍOrganization of requested registration cases into one project.

ㆍInheritance and gift tax attorney, tax accountant team assigned.

-

03. Project progress (inheritance tax report progress)01) Inherited property utilization plan and inheritance share discussion

- ㆍ Guide on required documents

- ㆍ Estimation of tax amount by comprehensively considering related tax amount such as capital gains tax

- ㆍ Determination of inheritance shares considering tax reduction plans such as acquisition tax and comprehensive Real Estate Holding Tax

- ㆍ Discussion on inheritance tax payment method

02) Review of pre-gift and presumed inheritance- ㆍ Analysis of decedent’s account transaction details

- ㆍ Analysis of withdrawal history for 2 years

- ㆍ Specific transaction details in question

03) Inspection of inheritance tax issues and preparation of reporting documents- ㆍ Determine the direction of reporting after inspecting inheritance tax issues

- ㆍ Determining the property evaluation method considering the client’s situation and tax reduction plan

- ㆍ Inheritance tax calculation and confirmation sent

04) Systemized work progress management- ㆍ Utilization of specialized programs for tax task

- ㆍ Data synchronization and systematic work management through the cloud

- ㆍ Immediate response to real-time issues

05) Convenient and prompt communication with clients- ㆍ Real-time communication with dedicated team through KakaoTalk dedicated channel and e-mail

- ㆍ Share tax issues, ask questions quickly, and send documents conveniently

-

04. Closure of work01) Final report

- ㆍ Final inspection of property status, reported issues, etc.

- ㆍ Report inheritance tax to the competent tax office and pay inheritance tax

02) Result report- ㆍ Issuance of a statement, receipt, payment form, etc. to the clien

03) Considering whether additional work is required- ㆍ We will respond in the event of a tax investigation

- ㆍ We will determine whether a tax appeal is necessary

04) Analysis- ㆍ Creation of case analysis data and joint research

- ㆍ Continuous accumulation of expertise and know-how

Ready to get professional help with your Inheritance/Gift Taxes?

(*English consultation available)

(*English consultation available)