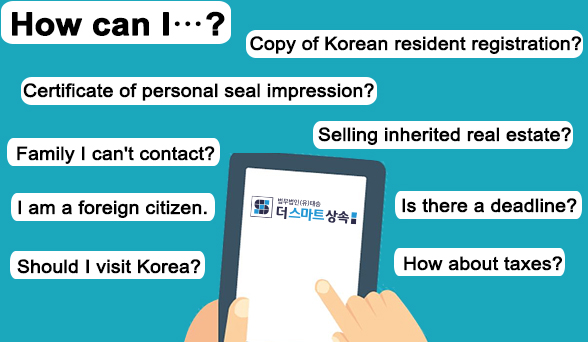

What if the decedent left property as a real estate? Inheritance Registration is required to dispose of inherited real estate.

3 main types of Inheritance Registration for overseas residents

When overseas citizen or permanent resident dies leaving real estate in Korea

Immigrated to the United States, Canada, etc.

and died there, or In case of death after returning to Korea.

and died there, or In case of death after returning to Korea.

In case the heirs live abroad

(citizens, permanent residents)

(citizens, permanent residents)

This is the case where the deceased died in Korea,

but some or all of the heirs live abroad.

but some or all of the heirs live abroad.

If there are heirs who have lost contact

In case some of the heirs are abroad, etc.,

communication has been cut off,

and the inheritance process is impossible.

communication has been cut off,

and the inheritance process is impossible.

Inheritance registration resolution procedure of The Smart Inheritance

We will take care of it accurately.

- You can proceed without entering Korea

- Preparation of all necessary documents writing and certification procedures required for overseas residents

- specific explanation of the relationship of inheritance

- In the case of acquisition of foreign real estate, a comprehensive agency for related procedures

- agency for the transfer of inherited property overseas

- Integration of inheritance tax, etc

- Other separate legal procedures for complete settlement

-

01. Consultation with a attorney specializing in inheritance registration

ㆍ Direct consultation with an attorney who is specialized in inheritance law officially registered with the Korean Bar Association.

ㆍ Suggesting the best registration plan considering tax savings and customer convenience.

-

02. Case request and dedicated team deployment

ㆍ Organization of requested registration cases into one project.

ㆍ Inheritance attorney, tax accountant, and inheritance registration staff team assigned.

-

03. Project progress (inheritance registration report progress)01) Discussion on how to handle inheritance

- ㆍ Prediction of tax amount such as inheritance tax, transfer tax, acquisition tax, etc.

- ㆍ Determination of share in inheritance considering discussion details and tax reduction plan

- ㆍ Depending on your place of residence/nationality, step-by-step progress is determined

- ㆍ Review all conditions to see if a burden-bearing gift is possible

02) Guidance of necessary documents- ㆍ Information on required documents for domestic heirs

- ㆍ Provides documents tailored to the country of residence of overseas heirs

- → Thorough preliminary review and analysis of laws by country so that the client can complete document preparation at once

03) Fill out registration application form- ㆍ Gathering required documents and reviewing additional documents

- ㆍ Write registration application and review additional issues

- ㆍ Final registration cost calculation

04) Acquisition tax report and registration application- ㆍ Acquisition tax report and payment

- ㆍ Final registration application to the competent registry office

05) Response to correction order and completion of registration- ㆍ Promptly respond to corrections made by the registration authority

- ㆍ Receipt of registration right certificate (01. Consultation with a attorney specializing in inheritance registration

- ㆍ Direct consultation with an inheritance attorney who is officially registered with the Korean Bar Association

- ㆍ Suggesting the best registration plan considering tax savings and customer convenience

-

04. Closure of work01) Send result

- ㆍ Provision of relevant documents such as a registration certificate, new certified copy of register, etc. to the client

- ㆍ Provision of documents for acknowledging expenses required for future transfer tax reporting (mail, e-mail)

02) Proceed with additional work (if necessary)- ㆍ Participation in the tax team when integrating inheritance tax reporting

- ㆍ Provision of necessary documents for loans to finance inheritance tax

- ㆍ Preparation of related documents for approval of export after sale

03) Analysis- ㆍ Creation of case analysis data and joint research

- ㆍ Continuous accumulation of expertise and know-how

Specialized in difficult and complicated Inheritance Registration

- Completed inheritance registration of real estate left in Korea by British father who died in Singapore.

- Completed inheritance registration of real estate left in Korea by a Canadian mother who died in the US.

- Completed inheritance registration of real estate left in Korea by New Zealand spouse who died in Australia.

- Completion of Korean real estate inheritance registration of an heir imprisoned in a US prison.

Ready to get professional help with registering the property you inherited?

(*English consultation available)

(*English consultation available)